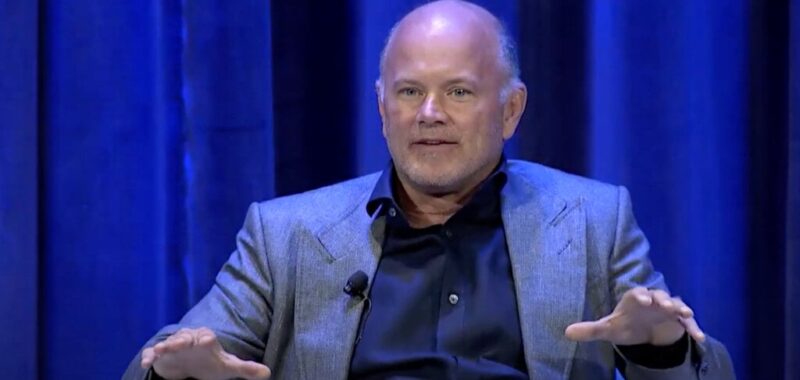

Galaxy Digital Holdings continued to operate at a loss last quarter as the cryptocurrency market cooled—but an executive shrugged off the news in an earnings call Thursday, citing the potentially massive impact that the incoming Trump presidency could have on its business. And CEO Mike Novogratz described Trump’s reelection as a massive moment for crypto.

The crypto firm reported a net loss of $54 million in the third quarter, marking its second straight quarter operating in the red. The company’s lackluster quarter came amid a steady decline in Ethereum‘s price and falling spot digital asset trading volumes, though the firm noted a rise in revenue despite those market hurdles.

Galaxy’s back-to-back losses—worth a combined $231 million—dragged down its year-to-date net income. Galaxy notched a $422 million profit in the first quarter of 2024 amid a broader crypto market rally that included a then-peak price for Bitcoin in March.

The firm’s net income currently stands at $191 million for the year, as of September 30.

Galaxy Digital Head of Investor Relations Johnathan Goldowski minimized the impact of the losses in a call with investors on Thursday.

“The last quarter seems a lot less relevant right now, given that this is kind of a whole new world,” Goldowski said, referring to the outcome of the U.S. presidential election.

Galaxy CEO Mike Novogratz also weighed in on the positive effect Trump’s win could have on the future of the crypto industry, calling it the “most important day for crypto”—despite his own vocal support for Trump’s rival, Vice President Kamala Harris.

Referencing SAB 121, a so-called anti-crypto Securities and Exchange Commission (SEC) rule that prevents financial institutions from providing crypto asset custody services, he said: “It’s going to get repealed very quickly.”

Novogratz further expects a wave of traditional finance world adoption of cryptocurrency on their balance sheets, and that such an embrace will “unleash a tsunami of institutional participation.

Galaxy’s down quarter

Galaxy operated at a loss last quarter amid moderately challenging crypto market conditions. The digital assets market cooled this summer amid rising geopolitical tensions. As a result, spot trading volumes fell 15% during the third quarter.

Meanwhile, ETH’s price fell more than 20% to roughly $2,600 last quarter, presenting another challenge for Galaxy’s businesses.

Galaxy has a fair amount of exposure to Ethereum’s native token. Last summer, Galaxy acquired CryptoManufaktur as part of its plan to grow its Ethereum staking capabilities, bringing in nearly $1 billion worth of ETH as part of the deal. The company also has several private funds that offer institutional investors exposure to Ethereum’s token.

However, those difficult market conditions didn’t completely kneecap the firm last quarter. The company’s revenue increased roughly 30% in the third quarter, largely fueled by the success of its trading business.

Galaxy has three businesses: the trading-focused Galaxy Global Markets; the institutional investments-focused Galaxy Asset Management; and Digital Infrastructure Solutions, which houses its mining operation.

Galaxy Global Markets’ counterparty trading revenue jumped 117% last quarter. Meanwhile, Galaxy’s mining and institutional-investments businesses were less successful, reporting 23% and 44% less quarterly revenue in Q3, respectively.

In its latest earnings call, Galaxy also unveiled plans to bolster its income with revenue from an AI-driven crypto mining business.

The company said on Thursday it struck a deal with an unidentified firm to convert its 800 megawatt (MW) power capacity to high-performance computing (HPC), which could make its mining business more profitable. Combining HPC infrastructure with artificial intelligence enables mining companies to mine Bitcoin in an efficient and cost-effective way.

Edited by Andrew Hayward