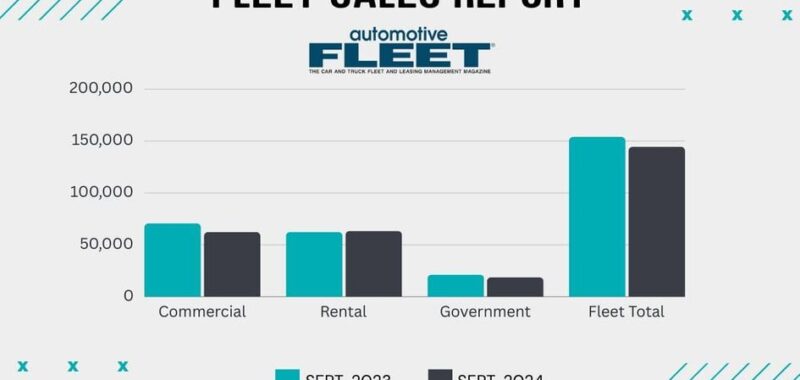

The combined sales for the three fleet sectors in September totaled 144,456 vehicles, down 6.4% from the September 2023 total of 154,000 fleet vehicle sales.

Overall, year-to-date fleet sales widened their decline last month compared to 2023 levels as commercial fleet sales fell at a higher rate, according to monthly Bobit fleet sales data released Oct. 1.

Fleet sales for the first three quarters of 2024 were 1,651,900, down 2.7% from 1,698,052 vehicles sold during the same period of 2023. 2024 fleet sales began flatlining in July.

The YTD decline can be attributed to an 8.4% dip in commercial fleet sales so far this year to 636,533 vehicles from 695,242 fleet vehicles sold in the first nine months of 2023.

Rental fleet sales are still up YTD at 804,089, for an increase of 1.3% compared to 793,561 rental vehicles sold the first three quarters of 2023.

Based on the automakers’ reports, government fleet sales stand at 211,278 vehicles sold YTD, up 1% from 209,249 sales in the same period last year.

The fleet sector breakdown of September 2024 versus September 2023 sales:

- Commercial Fleets: 62,359 vehicles were sold into commercial fleets in September 2024, compared to 70,645 in September of last year, for a decline of 11.7%.

- Rental Car Fleets: 63,400 vehicles were sold into rental fleets in September 2024, compared to 62,436 in September last year, for a 1.5% increase. However, sales spiked by 20,932 vehicles compared to the 42,468 sold into rental fleets in August.

- Government Fleets: Sales fell 12.3% to 18,697 vehicles in September 2024 from 21,319 in September last year. (Note: Apples-to-apples comparisons with government fleet sales are not possible because one or more OEMs do not report sales month to month. In July, Hyundai, Nissan, Subaru, and Toyota did not report sales to government fleets.)

The combined sales for the three fleet sectors in September totaled 144,456 vehicles, down 6.4% from the September 2023 total of 154,000 fleet vehicle sales.

“New vehicle sales into the rental fleets in September rose by almost 21,000 units, or almost 50%, versus August, which will provide much-needed late-model used units when these additional units come out of rental service,” said Tom Kontos, chief economist and analyst at Adesa. “On the other hand, commercial fleet sales showed month-over-month and year-over-year declines, limiting the availability of these units when they are remarketed a few years from now. All in all, total fleet sales of all types are down modestly on a year-to-date basis, indicating that the used vehicle supply of these units will remain fairly tight in the future.”

Bobit, owner of Automotive Fleet, Vehicle Remarketing, and Auto Rental News, compiles fleet sales numbers that reflect aggregate figures from the three major Detroit-based auto manufacturers and the Asian Big 6 automakers.

Originally posted on Automotive Fleet