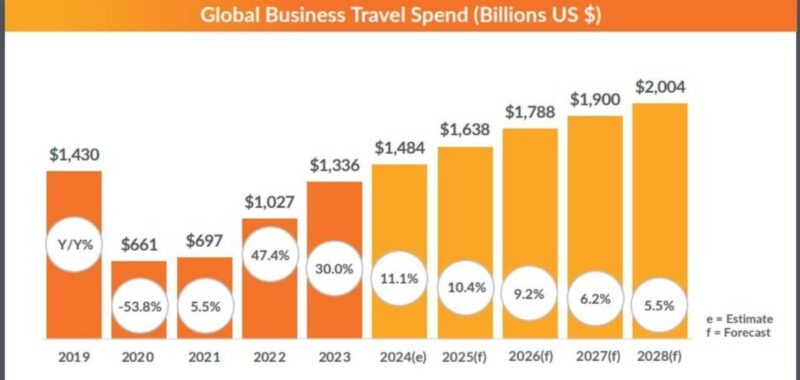

The forecast for 2024 predicts global business travel spending will reach $1.48 trillion by the end of the year, an increase on 2019 spending which was a previous record at $1.43 trillion.

Boosted by economic stability, pent-up demand and recovery momentum, business travel spending is projected to surpass $2 trillion by 2028, according to the latest GBTA Business Travel Index Report.

The business travel industry has proven itself resilient as it leaves the global pandemic behind and moves into a new era of post-pandemic stabilization.

The forecast for 2024 predicts global business travel spending will reach $1.48 trillion by the end of the year, an increase on 2019 spending which was a previous record at $1.43 trillion. Additionally, by 2028, it is projected to exceed $2 trillion, highlighting a robust path ahead for the business travel sector in terms of spending.

Relative stability in the global economy has continued to drive growth which, along with lingering pent-up demand, has provided reassurance for CEOs and CFOs to get their people back on the road for business meetings. Many top business travel markets around the world have returned to or are nearing pre-pandemic levels, reinforcing the momentum of the recovery and boosting spending. However, the outlook for economic and business travel growth presents a balance of both potential upside factors and downside risks.

While recovery has been impressive, the GBTA notes that when adjusted for inflation, spending levels are anticipated to lag pre-pandemic highs over the coming years, implying that business travel volumes will remain below pre-pandemic levels as well.

These findings are included in the latest 2024 GBTA Business Travel Index Outlook – Annual Global Report and Forecast (GBTA BTI) published by the Global Business Travel Association (GBTA) that was unveiled July 22 at the GBTA Convention 2024 in Atlanta.

Global business travel spending is expected to increase 11.1% in 2024, after significant years in 2022 and 2023 of 30%-47% growth year over year. Growth is expected to gradually moderate, resulting in an annual compound growth rate of 6.95% from 2025 to 2028.

In 2023, the business travel industry had recovered about $675 billion of the $770 billion lost in 2020, according to GBTA BTI analysis, achieving 93% of the pre-pandemic peak of $1.43 trillion by the end of 2023. The sector surged in 2023, with spending growing by 30% compared to 2022, reaching $1.3 trillion.

GBTA Report Stats & Facts

Highlights from the 2024 GBTA BTI Outlook:

- Global business travel spending is expected to recover to its pre-pandemic total of $1.48 trillion in 2024, fueled by more favorable economic conditions than expected in 2022 and 2023.

- The estimated breakdown of the $1.34 trillion in 2023 business travel expenditures includes $501 billion for lodging, $282 billion for air travel, $245 billion for food and beverage, $165 billion for ground transportation and $142 billion for other travel expenses.

- Recovery in business travel continues to vary by region. Asia Pacific emerged as the fastest-growing region in 2023 (36%), followed by Western Europe (33%) and North America (25%). The recovery bounce back was led in 2023 by the U.S, Middle East and Africa, and Latin America, all achieving 100% or more of 2019 spending numbers. For 2024, China and the U.S. are forecast to continue to lead as the top two markets, respectively, for overall business travel spending.

- Business travel spending also differs across industries. The financial and insurance activities sector is projected to see the most expansion (72%) in business travel spending through 2028. Conversely, the retail trade (41%) and agriculture, forestry and fishing (32%) sectors are expected to see the least growth during this period.

- With an optimistic outlook overall, there are factors that could impact business travel’s longer-term forecast. Persistent inflation, China’s slower recovery, geopolitical tensions, industry workforce challenges and incidence of natural disasters could result in shifts to the outlook. Increased focus on corporate sustainability also has the potential to impact the sector, demonstrating the vital importance of coordinated action across the industry for business travel’s future.

- Potential upside impacts for the business travel sector include ongoing economic stability, technological advancements, particularly in artificial intelligence (AI), and stronger-than-expected economic growth in key markets like the U.S. and India.

- GBTA’s survey of 4,100 business travelers across 28 countries and four regions (North America, Europe, Asia Pacific, and Latin America), revealed an increase in overall business travel, with international travel remaining below average. 64% of business travelers globally report increased spending on business travel compared to 2023. However, over one-third (37%) say they have experienced more restrictive travel policies since pre-COVID.

- Business travelers globally estimate their own spending, on average, amounts to $834 per person based on their last business trip. Lodging accounts for $312, on average, and food and beverage is $153. Air travel averages $176 while ground transportation ($103) and miscellaneous expenses ($89) round out the total.

- Most survey respondents (81%) reported that their most recent business trip was very (46%) or moderately (35%) worthwhile in achieving their business goals. When asked about their most recent business trip, the most common purpose of travel among all global business travelers is attending seminars/training followed by conventions/conferences.

- Compared to 2019, 76% of business travelers traveled the same or more for business travel. Those traveling more (28%) outpaced those who travel less (20%) over the same period. Although overall business travel has increased, both international and group travel remain, on average, lower than 2019 levels. Two-fifths (40%) of the trips taken are three-to-five-night stays, while two-night stays account for one-third (32%). Additionally, 58% said they extended work trips for leisure or vacation about the same (41%) or more frequently (17%) than previous.

Download the executive summary here for the 2024 Business Travel Index Outlook report. GBTA members can exclusively access the full BTI report on the GBTA Hub.