The steepest year-over-year drop last month happened among rental car fleets.

While overall vehicle sales to the rental, commercial, and government fleet sectors are straddling 2023 levels, rental fleets are still holding their own year-to-date, according to monthly Bobit fleet sales data released Sept. 4.

Fleet sales for the first eight months of 2024 were 1,507,444, down 2.3% from 1,543,652 vehicles sold during the same period of 2023. It’s the first year-to-date-year-over-year decline in 2024. After total fleet sales in 2023 soared 28% over 2022 figures, the post-pandemic comeback phase appears to be petering out.

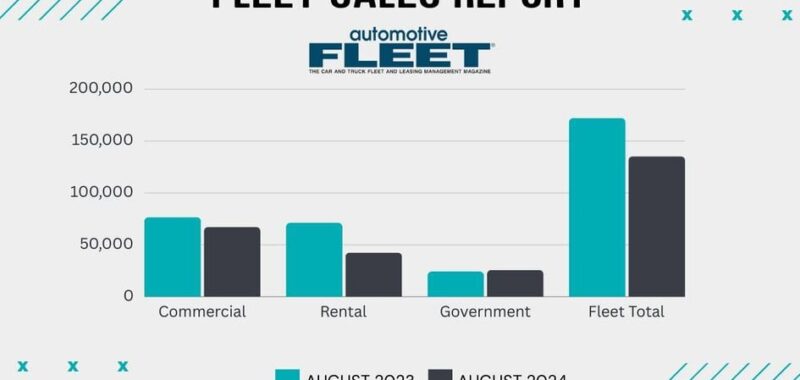

The steepest year-over-year drop last month happened among rental car fleets, where sales fell 40.3% from 71,189 vehicles sold in August 2023 compared to 42,468 vehicles sold into rental fleets last month. But rental fleet sales are still up 1.3% YTD at 740,689 vehicles versus 731,125 sold in Jan-Aug. 2023.

The overall fleet sales YTD decline can be attributed to an 8.1% decline in commercial fleet sales so far this year, as YTD sales fell to 574,174 vehicles compared to 624,597 commercial fleet vehicles sold in the first eight months of 2023.

Government fleet sales, based on the automakers reporting, stand at 192,581 vehicles sold YTD, up 2.5% from the same period last year.

The automotive fleet sector has returned to more normal sales rhythms after three years of supply chain, manufacturing, and inventory recovery. Other fleet sector breakdowns of August 2024 versus August 2023 sales were the following:

- Commercial Fleets: 67,119 vehicles were sold into commercial fleets in August 2024, compared to 76,597 in August of last year, for a decline of 12.4%.

- Government Fleets: Fleet vehicle sales rose to 25,670 in August 2024 from 24,289 in the same month last year, rising 5.7%. (Note: Apples-to-apples comparisons with government fleet sales are not possible due to one or more OEMs not reporting any sales from month to month. In July Hyundai, Nissan, Subaru, and Toyota did not report any sales to government fleets).

The combined sales for the three fleet sectors in August totaled 135,257 vehicles, down 21.4% from the August 2023 total of 172,075 fleet vehicle sales.

“It seems to me that manufacturers are being very disciplined in not overselling into rental and commercial fleets while retail new vehicle sales are soft,” said Tom Kontos, a vehicle remarketing analyst and former chief economist for Adesa Auctions U.S. Kontos called the fleet sales direction unusual and holds out the possibility that fleet sales could recover in coming months.

“Even with the slowdown, I continue to be encouraged by the year-to-date uptick in rental (fleet) sales, although it is now only a modest 1.3%,” Kontos said. “These units are in high demand at auction, as dealers seek to find more-affordable nearly-new units for consumers.”

Bobit, owner of Automotive Fleet, Vehicle Remarketing, and Auto Rental News, compiles fleet sales numbers that reflect aggregate figures from the three major Detroit-based auto manufacturers and the Asian Big 6 automakers.